THE 2024 STATE OF PHISHING REPORT IS PUBLISHED! READ THE REPORT HERE

-

Solutions

Solutions

-

By Channel

Read the company overview to learn more about how Perception Point provides unparalleled prevention of advanced cyber threats across all attack vectors.

-

Email

Download this complimentary Gartner report.

-

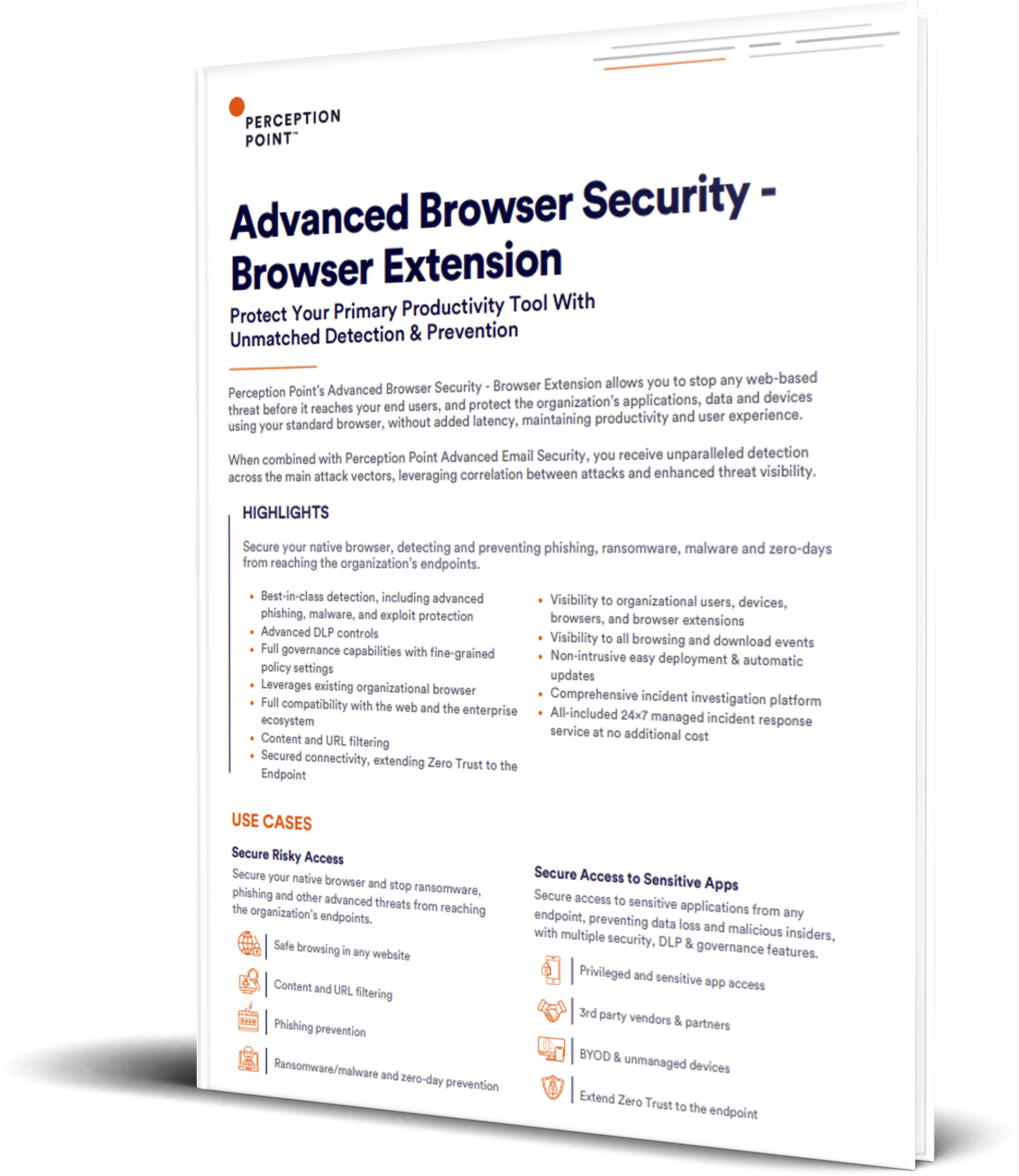

Web Browser

Web Browser

Download the Advanced Browser Security solution paper.

-

Cloud Collaboration

Cloud Collaboration

Read the brochure to learn more about Advanced Cloud Collaboration Security.

-

Web Apps & File Uploads

Check out the solution paper on Advanced Threat Protection for Web Apps.

-

By Platform

By Platform

Read this case study to see how we helped a high-tech enterprise secure 3 collaboration channels: MS Teams, OneDrive, and SharePoint.

-

By Attack Type

By Attack Type

Read the company overview to learn more about how Perception point provides unparalleled prevention of all attacks across email, web browsers and cloud collaboration apps.

-

Detection Technology

Detection Technology

Read the company overview to learn more about how Perception point provides unparalleled prevention of all attacks across email, web browsers and cloud collaboration apps.

-

By Channel

-

Services

Learn more about Perception Point’s Managed Service.

-

Partners

Partners

-

Partnerships

Partnerships

-

Technology and Alliance Partners

Technology and Alliance Partners

Learn more about the Perception Point Partner Program. Protect your customers from all threats across top attack vectors with one platform.

-

Partnerships

-

Resources

Resources

- Guides

-

Blog

Keep up with Perception Point’s updates and new offerings on our blog, here.

-

Case Studies

Learn how Red Bull augmented Microsoft EOP to prevent attacks in the case study, here.

-

Datasheets

Access the datasheet to learn about the use cases, technical specifications, and the key features of our Security Browser Extension

-

White Papers

Download this whitepaper to learn how today’s digital-first enterprises can protect themselves against advanced threats.

-

Reports

Download the 2023 Gartner Market Guide for Email Security.

- Webinars

-

eBooks

Download this ebook to get a thorough overview of the most current email security challenges and how to mitigate them through best practices.

-

Brochures

Reach this brochure to learn how Advanced Email Security combines cutting edge threat prevention with the speed, scale and flexibility of the cloud.

-

ROI Calculator

Use this calculator to assess the potential benefit of deploying Perception Point with just 3 variables. We will do the rest for you.

-

Checklist

Are you managing a remote team? Download this IT Checklist to make sure you’re organization is secure.

- Company